In the 2021-2022 Federal Budget the Federal government announced that the current individual tax residency rules will be replaced with new tests, based on recommendations made by the Board of Taxation in their report dated March 2019.

The changes will apply from 1 July of the financial year after the enabling legislation is passed. Given that draft legislation has yet to be tabled, the earliest date the new rules can apply is 1 July 2023 and it may the following year.

One of the problems with applying the current tax residence rules is that the Australian Taxation Office’s ruling on the matter, IT 2650 is not sufficiently precise for outbound expats to determine at what point they have ceased to be tax residents of Australia.

The ruling was issued in 1991 and, whilst there has been a significant body of case law developed over the last 30 years, it can still be difficult to determine the precise moment when an expat has ceased to be tax resident of Australia.

One of the most recent cases on the matter – Harding v Commissioner of Taxation – is an example of how a person’s tax residence can turn on a particular set of facts.

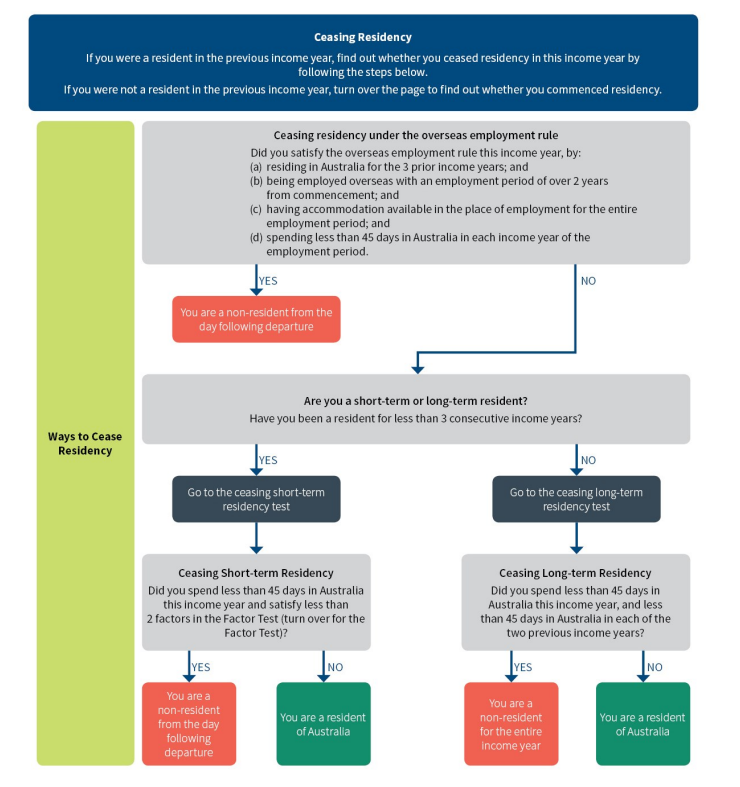

Ceasing residency

The proposed rules for ceasing residency are outlined on page 18 of the Board of Taxation’s report. The table below is extracted from that report:

The overseas employment rule essentially codifies some elements of IT 2650 including needing to be overseas for a period of at least 2 years and having accommodation available in the place of employment for the entire period of employment.

Commencing residency

The inbound tax residence rules are shown on page 17 of the Board of Taxation’s report and are reproduced below:

In the Budget Papers the new primary test is a simple ‘bright line’ test and arguably much tighter than the existing rules. The secondary ‘factor’ tests are also likely to result in many inbound visits triggering tax residence much earlier than would have otherwise been the case.

As an example, an expat who was on a 7-week holiday in Australia (49 days) and was (a) a citizen (thus passing factor #1) and (b) having Australian economic interests (passing factor #4), could be regarded as being tax resident under the above rules.

Under the current rules, the expat who was visiting Australia for a short time and was tax resident overseas would typically need to be in Australia for at least 183 days (183 day test) before triggering tax residence and could still avoid triggering tax residence if they had a permanent place of abode overseas.

Application of Double Tax Treaty

It should be noted that Australia has Double Tax Treaties with 45 countries around the world and easy treaty has so called ‘tie breaker’ rules in respect of tax residence.

Triggering tax residence in Australia doesn’t mean you immediately cease to be tax resident in an overseas country where you have previously established tax residence. It is necessary to apply the tie breaker rules – which can vary from one treaty to the next – to determine which country you are tax resident.

Typically, the tie breaker rules work to ensure an individual is tax resident one country or another even if they are tax resident under the domestic tax rules of two countries.

For those expats who are based in a country where no treaty is in place, they will need to be much more cautious about their visits to Australia if and when the new rules come into operation.

Early days for these changes

It should be noted that the current tax residence rules will continue to apply up until the new rules are in force. If you are concerned about how the new rules might affect your situation, you should seek tax advice from a practitioner who is skilled in interpreting international tax law.